Working with Hedge Funds

The following flows apply to hedge fund capital accounting:

initial fund/offering setup (see Flows: For All Investment Vehicles)

transfers (see Flows: For All Investment Vehicles)

initial investments

distributions

The initial investments for a hedge fund have the following flow, with securities issued when the Asset Manager or Fund Admin runs a close for a batch of settled shares. This flow assumes that:

The investing org has been assigned to the fund.

The investing org has accepted that assignment.

The Integration API refers to the initial step in subscribing as "creating an asset."

1

Inv - Create Asset (Lot)

2

AM - Reject Asset (Investment) AM - Mark Assets Batch as Accepted

3

Inv - Mark Assets Batch as Wired

4

AM/FA - Mark Assets Batch as Settled

5

AM/FA - Run Close

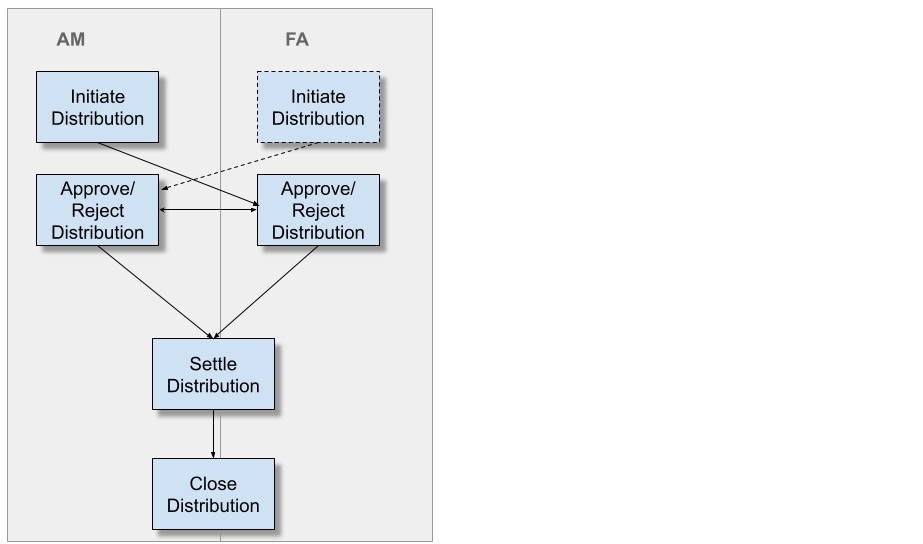

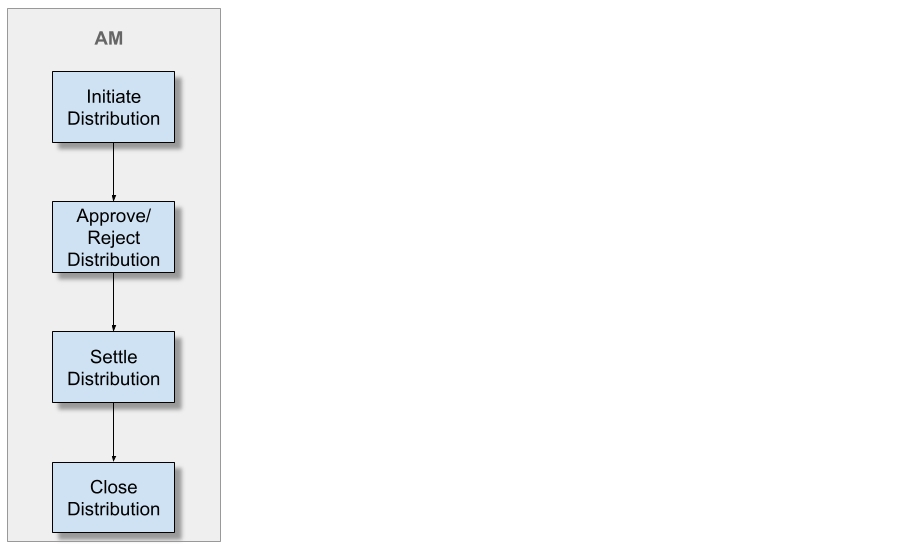

If a hedge fund is configured for distributions, the event can be started by either the general partner or the fund administrator, and both parties must approve.

If there is no fund admin, then the general partner must still approve.

1

AM/FA - Initiate Distribution

2

AM/FA - Approve/Reject Distribution

3

AM/FA - Settle Distribution

4

AM/FA - Close Distribution