Working with Dropdown Funds

The following flows apply to drawdown funds:

initial fund/offering setup (see Flows: For All Investment Vehicles)

transfers (see Flows: For All Investment Vehicles)

initial investments

capital calls

distributions

The initial investments for a drawdown fund have the following flow, with securities issued when the Asset Manager or Fund Admin runs a close for a batch of accepted shares. This flow assumes that:

The investing org has been assigned to the fund.

The investing org has accepted that assignment.

The Integration API refers to the initial step in subscribing as "creating an asset."

1

Inv - Create Asset (Lot)

2

AM - Reject Asset (Investment) AM - Mark Assets Batch as Accepted

3

AM/FA - Run Close

If a drawdown fund is configured for capital calls, the event can be started by either the general partner or the fund administrator, and both parties must approve.

If there is no fund admin, then the general partner must still approve.

1

AM/FA - Initiate Capital Call

2

AM/FA - Approve/Reject Capital Call

3

Inv - Fund Capital Call (Mark as Funded)

4

AM/FA - Settle Capital Call

5

AM/FA - Close Capital Call

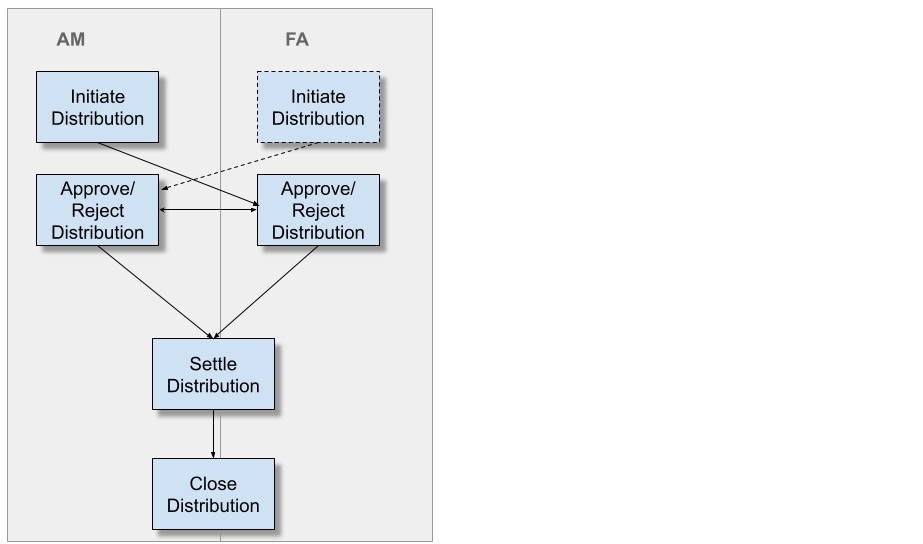

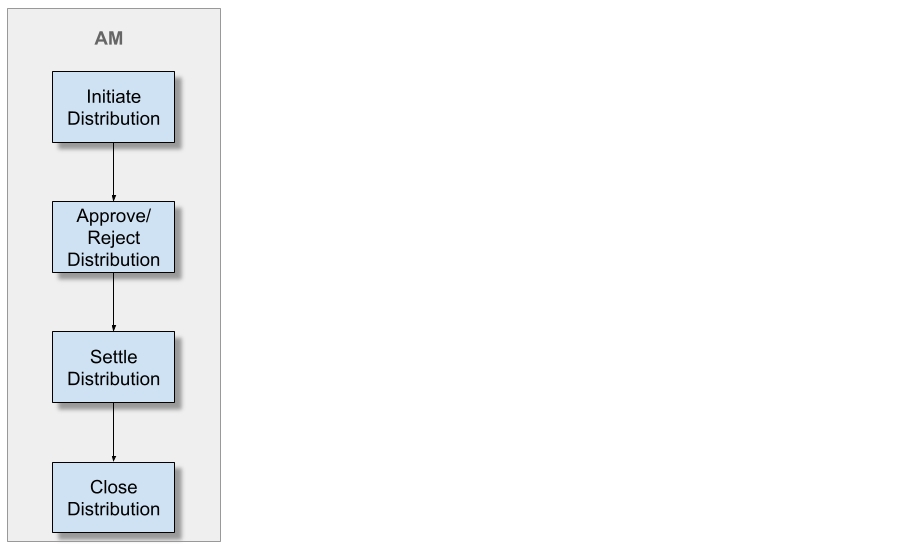

If a drawdown fund is configured for distributions, the event can be started by either the general partner or the fund administrator, and both parties must approve.

If there is no fund admin, then the general partner must still approve.

1

AM/FA - Initiate Distribution

2

AM/FA - Approve/Reject Distribution

3

AM/FA - Settle Distribution

4

AM/FA - Close Distribution